Running a small business means juggling multiple responsibilities—but managing your finances shouldn’t be one of your daily struggles. That’s where small business accounting software comes into play. With the right tool, you can simplify bookkeeping, track income and expenses, generate financial reports, and stay compliant with tax regulations.

But with so many options available in 2025, how do you choose the best one?

In this comprehensive guide, we’ll walk you through everything a business owner needs to know about small business accounting software—from must-have features and benefits to expert tips on choosing the right platform.

✅ Why Accounting Software Matters for Small Businesses

Many small businesses still depend on spreadsheets or manual record-keeping. This often leads to missed transactions, tax filing errors, and cash flow confusion. Accounting software automates these processes, offering real-time insights while reducing errors and saving valuable time.

Here’s why modern accounting software is essential:

- Real-time expense tracking

- Easy invoice generation

- Automatic bank reconciliation

- Tax-ready financial reports

- Cash flow forecasting

💡 Fact: According to recent surveys, businesses that use accounting software are 75% more likely to stay financially organized and compliant with taxes.

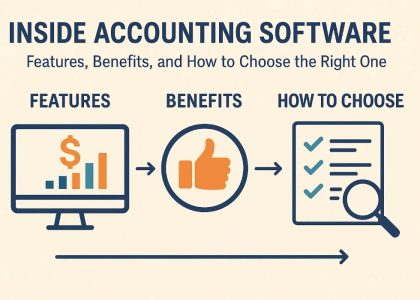

🛠️ Must-Have Features in Small Business Accounting Software

Before committing to any software, ensure it includes the features that will support your financial workflow and business growth:

1. Invoicing and Billing

Create, send, and manage professional invoices with ease. Look for features such as recurring billing and automated payment reminders.

2. Expense Tracking

Track business expenses by category, upload receipts effortlessly, and stay in control of your budget.

3. Bank Integration

Connect your bank accounts to auto-import transactions and reconcile them in minutes—saving time and reducing manual errors.

4. Tax Management

Generate GST or VAT-compliant invoices, calculate tax liabilities, and stay ready for audits or returns.

5. Reporting and Dashboards

Access real-time reports like profit & loss, balance sheets, and cash flow statements. A modern dashboard offers instant financial visibility.

6. User Access and Permissions

Assign role-based access to team members or accountants, ensuring secure collaboration without compromising data integrity.

🚀 Key Benefits of Using Accounting Software

Investing in accounting software offers more than convenience—it builds the foundation for better financial health and smarter decision-making.

- Time-Saving: Handles routine tasks like data entry and report creation automatically.

- Reduces Errors: Eliminates common manual mistakes and ensures cleaner records.

- Improves Decision-Making: Offers up-to-date financial data for smarter planning.

- Tax Made Easy: Organizes all your tax-related information in one central location.

- Enhances Professionalism: Generates clean, branded invoices and reports.

🏆 Top Small Business Accounting Software for 2025

Here are the most trusted accounting tools for small business owners in 2025:

| Software | Best For | Starting Price |

|---|---|---|

| Zoho Books | All-in-one cloud accounting | ₹749/month |

| QuickBooks | Scalability & integrations | ₹529/month |

| FreshBooks | Freelancers & service-based | ₹499/month |

| TallyPrime | Indian businesses & GST filing | ₹630/month |

| Xero | Multi-currency & reporting | ₹900/month |

🔍 Tip: Try a free trial first to explore the features and test the interface before making your final decision.

📌 Tips for Selecting the Best Accounting Software for Your Business

Not every accounting tool suits every business. Use this checklist to choose a platform that fits your specific needs:

Is it cloud-based and mobile-friendly?

Does it support GST compliance and tax reporting?

Can the software scale with your business?

Does it support your industry (e.g., retail, services, eCommerce)?

Does it offer seamless integrations with CRM, payroll, or POS systems?

Is responsive customer support available?

Choose a tool that supports your daily operations, not just one with flashy features.

⚠️ Common Mistakes to Avoid

Don’t fall into these traps when selecting accounting software:

❌ Ignoring scalability for future growth

❌ Choosing based only on low pricing

❌ Skipping product trials or demos

❌ Overlooking tax compliance features

❌ Not checking software integrations

Making an informed decision now will save you time, money, and frustration down the line.

💼 Final Thoughts: Make Accounting a Strength, Not a Struggle

Accounting shouldn’t feel like a burden. With the right software, you’ll have more time to focus on growing your business, building client relationships, and improving your products or services.

Instead of juggling spreadsheets and receipts, let automation take over your finances. Today’s accounting software provides the clarity, compliance, and confidence every business owner needs to thrive in a competitive world.