In today’s fast-paced business environment, managing finances manually isn’t just outdated—it’s risky. Accounting software has become a powerful tool for business owners, freelancers, and finance teams. It streamlines processes, reduces errors, and gives you a real-time view of your business’s financial health.

This guide explores the core features, benefits, and practical tips for choosing the best accounting software for your business.

💼 What Is Accounting Software?

Accounting software is a digital solution that helps businesses record, manage, and report financial transactions. It automates everyday accounting tasks like bookkeeping, invoicing, tax calculations, and financial reporting—saving valuable time and effort.

Whether you’re a small business owner or managing enterprise-level finances, accounting software simplifies your workflow and ensures accuracy.

🧩 Key Features to Look For in Accounting Software

Choosing the right tool starts with understanding what features matter most. Here are the essential ones:

1. Invoicing and Billing

Generate professional invoices, set up recurring billing, and send automatic payment reminders—ensuring faster payments.

2. Expense Tracking

Categorize expenses, upload receipts, and track where every rupee goes. This helps monitor cash flow and control budgets effectively.

3. Bank Integration

Sync your bank accounts to automatically import and reconcile transactions. This eliminates manual data entry and reduces errors.

4. Financial Reporting

Access real-time reports like profit & loss statements, balance sheets, and cash flow summaries to make informed decisions.

5. Inventory Management

Track stock levels, set reorder alerts, and monitor product performance—all from the same dashboard.

6. Payroll Management

Process employee salaries, handle deductions, and stay compliant with labor laws effortlessly.

7. Multi-User Access and Permissions

Collaborate with your accountant or finance team by assigning roles and access levels based on responsibility.

8. Cloud Accessibility

Access your financial data anytime, from any device. This ensures flexibility for remote teams and business owners on the move.

✅ Benefits of Using Accounting Software

Accounting tools offer more than just automation—they transform how you manage your business finances:

1. Time-Saving

By automating repetitive tasks, you free up time for strategic planning and customer engagement.

2. Improved Accuracy

Built-in calculators and validations reduce the chances of human error in data entry and calculations.

3. Better Compliance

Keep tax records organized and updated with current regulations, reducing the risk of penalties.

4. Real-Time Financial Insights

Gain immediate access to updated financial metrics and reports, helping you make better, faster decisions.

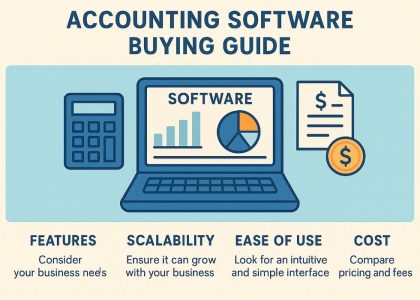

5. Scalability

As your business grows, your accounting software should grow with it—by adding more users, features, or integrations.

🧭 How to Choose the Right Accounting Software

With dozens of tools on the market, making the right choice can feel overwhelming. Follow these tips:

1. Define Your Needs

Start by listing what you need: invoicing, tax filing, inventory tracking, or payroll. Your business size and industry matter here.

2. Try Before You Buy

Opt for free trials or demos. This allows you to test the interface, usability, and key features before making a financial commitment.

3. Check for Integration

Ensure the software integrates with tools you already use, like CRM systems, payment gateways, or e-commerce platforms.

4. Consider Your Budget

While free tools are available, premium software offers better security, support, and advanced features. Choose what fits your budget.

5. Read Reviews and Compare Options

Look at user reviews, expert comparisons, and case studies. These insights can help you spot software strengths and weaknesses.

💡 Popular Accounting Software in 2025

Here are some top-rated tools based on features and ease of use:

- QuickBooks: Great for small businesses and freelancers

- Zoho Books: Excellent for automation and tax compliance

- TallyPrime: Preferred by Indian businesses for GST billing

- Xero: Cloud-first accounting with strong reporting features

- FreshBooks: Simple, user-friendly, and built for service-based businesses

📌 Final Thoughts

The right accounting software can simplify your finances, save time, and empower you to grow your business confidently. Don’t treat it as just another tool—think of it as a financial partner. Whether you’re running a startup or managing a growing enterprise, investing in the right software today can pay dividends in the long run.